Last Updated: November 18, 2025

Investing a large sum like $1 million or more requires careful planning and the right financial partner. Choosing the best US brokers for $1M+ investors can help you access exclusive investment opportunities and personalized services tailored to your wealth. The broker you pick can impact your returns, fees, and overall experience. For more details on why choosing the right broker matters, you can visit Investopedia.

Many high-net-worth investors look for brokers who provide expert advice, advanced tools, and low-cost trading. These brokers offer more than just a platform they deliver customized wealth management, tax strategies, and access to alternative assets. With so many options, knowing which brokers truly stand out is essential. Learn more about the benefits of wealth management services at NerdWallet.

In this article, you will discover the top US brokers that cater to investors with $1 million or more. We will discuss their fees, services, and what makes them a good fit for your financial goals. Whether you are new to managing a large portfolio or looking to switch brokers, this guide will help.

- Choosing the right broker is essential for protecting and growing your wealth.

- Look for personalized advice tailored to your unique financial goals.

- Access to exclusive investments can diversify your portfolio and may help improve potential returns.

- Low and transparent fees help maximize your net investment gains.

- Advanced research tools and strong customer support improve your investing experience.

Why Choosing the Right US Broker Matters for $1M+ Investors

When you have $1 million or more to invest, your financial needs become more complex. It’s not just about buying and selling stocks; it’s about protecting your wealth, minimizing taxes, and finding smart growth opportunities. The right US broker can offer specialized services that help you achieve these goals.

A broker designed for high-net-worth investors understands the importance of personalized advice. Instead of generic recommendations, you get strategies tailored to your unique situation, risk tolerance, and long-term plans. This can make a big difference in your investment success.

Another critical factor is access. Top brokers often provide investment opportunities like private equity or hedge funds that are typically limited to accredited investors under SEC guidelines. This diversification can enhance portfolio stability and provide opportunities for potential growth.

Additionally, these brokers typically offer advanced technology and tools. You can track your investments, run detailed analyses, and get real-time insights all of which help you make smarter decisions faster. Plus, excellent customer support means your questions get answered quickly.

Choosing the wrong broker can cost you money in higher fees, missed opportunities, or poor advice. So it’s worth spending time to find one that fits your needs perfectly. A good broker acts as a trusted partner on your journey to growing and protecting your wealth.

Key Benefits of the Right US Broker for $1M+ Investors:

- Personalized Wealth Management: Tailored investment strategies based on your financial goals and risk profile.

- Access to Exclusive Investments: Opportunities to invest in private equity, hedge funds, and other alternatives.

- Lower Fees on Large Portfolios: Many brokers offer reduced fees or customized pricing for high-net-worth clients.

- Advanced Technology and Tools: User-friendly platforms with real-time data, portfolio analysis, and trading options.

- Dedicated Financial Advisors: Expert advice and ongoing support to help you make informed decisions.

- Tax Efficiency: Strategies to minimize tax liabilities and maximize after-tax returns.

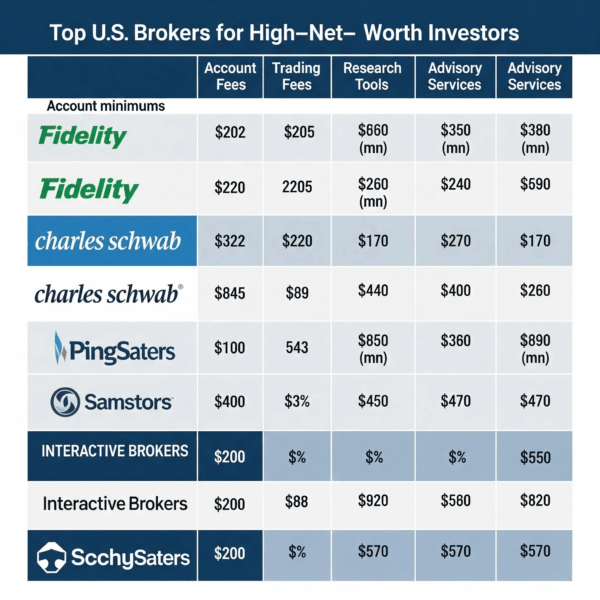

| Broker | Best For | Key Features | Estimated Fees |

|---|---|---|---|

| Fidelity | Personalized Wealth Management | Dedicated advisor, wide investments, estate planning | 0.50%–1.00% annually |

| Charles Schwab | Low Fees & Full-Service | No commissions, robust tools, financial consultants | 0.35%–0.75% annually |

| Morgan Stanley | Exclusive Investment Access | Private equity, hedge funds, global portfolios | 0.50%–1.25% annually |

| J.P. Morgan Private Bank | Ultra-High-Net-Worth Clients | Custom portfolios, global access, trust services | Custom-tiered; varies |

| UBS Wealth Management | International Investment Solutions | Cross-border strategies, family office services | 0.75%–1.25% annually |

Fidelity Brokers: A Top Choice Among US Brokers for $1M+ Investors

Fidelity is one of the most trusted names among US brokers catering to investors with $1 million or more. Their Private Wealth Management service focuses on delivering personalized financial advice and tailored investment strategies. This helps high-net-worth clients optimize their portfolios for growth while managing risks and taxes efficiently.

With Fidelity, you get access to a wide variety of investment options, including stocks, ETFs, mutual funds, bonds, and alternative assets. This extensive offering allows investors to diversify their holdings and seize opportunities across different markets. The platform is user-friendly, which makes managing large portfolios easier for both new and experienced investors.

Fidelity’s reputation for excellent customer service and advanced research tools sets it apart. Investors can easily track their portfolios, analyze performance, and make data-driven decisions. Whether you want to plan for retirement or manage your estate, Fidelity offers comprehensive resources to protect and grow your wealth over time.

- Personalized Wealth Management: Fidelity assigns you a dedicated advisor who works closely with you to develop a customized investment plan. This personalized attention ensures your portfolio aligns with your financial goals and risk tolerance.

- Wide Investment Options: Access a broad selection of stocks, bonds, ETFs, mutual funds, and alternatives to build a diversified portfolio suited to your needs.

- Competitive Fees: Fidelity charges between 0.50% and 1.00% annually, balancing cost and quality service to maximize returns.

- Advanced Research Tools: Use Fidelity’s intuitive platform for real-time portfolio tracking, detailed reports, and market research.

- Retirement and Estate Planning: Benefit from expert guidance in retirement savings and estate transfer to protect your wealth for the future.

Charles Schwab Brokers: Best for Low Fees and Full-Service Support

Charles Schwab is a popular choice among US brokers offering low fees paired with comprehensive financial support. Their Private Client program provides commission-free trading on stocks and ETFs, helping investors reduce trading costs and improve net returns. Schwab’s services blend affordability with expert advice.

Clients working with Schwab receive personalized attention through dedicated financial consultants. These experts help tailor your investment plan to your goals, risk profile, and liquidity needs. Schwab also provides retirement, tax, and estate planning to offer a complete wealth management solution.

One of Schwab’s key strengths is its technology. The platform delivers real-time market data, robust research, and easy portfolio management across devices. This ensures you can access your accounts and make informed decisions anytime, anywhere, whether on desktop or mobile.

- No Commission Trading: Trade stocks and ETFs without paying commissions, lowering overall investment costs.

- Dedicated Financial Consultants: Receive personalized guidance and planning tailored to your specific financial situation.

- Robust Technology and Research: Access market data, research reports, and portfolio analysis tools via Schwab’s intuitive platform.

- Low and Transparent Fees: Pay annual fees between 0.35% and 0.75%, combining affordability with quality service.

- Comprehensive Financial Planning: Benefit from holistic planning covering retirement, taxes, and estate matters.

Morgan Stanley Brokers: Access to Exclusive Investments for High Net Worth

Morgan Stanley is a leading US broker specializing in ultra-high-net-worth clients. With a higher minimum investment requirement, typically $2 million, they focus on offering exclusive opportunities and advanced financial strategies to grow and protect complex portfolios. Their services cater to investors seeking premium wealth management.

Morgan Stanley clients gain access to alternatives such as private equity, hedge funds, and real estate opportunities. These investments are typically available only to accredited investors under SEC guidelines. Such diversification provides exposure beyond stocks and bonds and may offer higher potential returns while balancing risk.

Their advisors also support estate and tax planning. For official tax information, consult the Internal Revenue Service (IRS), and for estate planning basics, see USA.gov.

- Alternative Investment Access: Invest in private equity, hedge funds, and real estate unavailable to most investors, increasing diversification.

- Customized Wealth Management: Receive tailored financial plans that include tax optimization, estate planning, and global asset allocation.

- Premium Service Fees: Fees range from 0.50% to 1.25%, reflecting the high-touch, exclusive services offered.

- Estate and Tax Planning Expertise: Morgan Stanley provides planning strategies that may help preserve wealth and address tax considerations.

- Global Investment Opportunities: Build diversified portfolios with access to international markets and alternative assets.

What to Consider When Choosing US Brokers for $1M+ Investors

Choosing the right broker is one of the most important decisions for investors with $1 million or more. Your broker will not only hold and manage your assets but also guide your investment strategies and help protect your wealth. Because of this, you need to carefully evaluate your options to find the best fit for your financial goals and preferences.

High-net-worth investors have different needs compared to average investors. You may require personalized advice, access to exclusive investment products, and sophisticated tax and estate planning. Not all brokers offer the same level of service or investment opportunities, so it’s important to know what to look for before committing.

Technology and user experience also matter. You want a broker whose platform is easy to use but powerful enough to offer real-time data, research, and portfolio management tools. Mobile access is important, too, as it allows you to monitor and adjust your investments anytime, anywhere.

Lastly, fees can vary widely between brokers. Even a small difference in fees can affect your returns over time, especially with a large portfolio. Understanding the fee structure and what services are included will help you avoid surprises and get the best value for your money.

Key Factors to Consider When Choosing US Brokers for $1M+ Investors:

- Personalized Advice and Support:

A dedicated financial advisor who understands your unique situation can provide tailored investment strategies and ongoing support. Personalized advice helps align your investments with your long-term goals and risk tolerance. - Investment Options and Access:

Look for brokers offering a wide range of investments, including stocks, bonds, ETFs, mutual funds, and alternative assets like private equity or hedge funds. Access to exclusive products can improve portfolio diversification and growth potential. - Technology and Trading Platforms:

A user-friendly platform with real-time market data, research tools, and portfolio analysis is essential. Good technology allows you to make informed decisions quickly and manage your investments efficiently on both desktop and mobile devices. - Fees and Pricing Structure:

Compare fee schedules, including management fees, trading commissions, and any additional costs. Some brokers offer tiered or negotiable fees for large portfolios, so ask about discounts or special pricing for high-net-worth clients. - Reputation and Security:

Choose brokers regulated by the U.S. Securities and Exchange Commission (SEC) and overseen by the Financial Industry Regulatory Authority (FINRA). Security measures to protect your data and assets are crucial. - Customer Service and Communication:

Reliable, responsive customer support makes a big difference. Brokers who provide regular updates, easy access to your advisor, and clear communication can improve your investing experience.

Final Thoughts

Choosing the right U.S. broker when you have $1 million or more is an important step toward managing and protecting wealth. The best brokers provide tailored advice, competitive fees, and access to exclusive opportunities regulated under SEC and FINRA oversight.

For general investor education, visit Investor.gov, the SEC’s official resource for the public.

Remember, the right broker is more than just a platform they are your trusted partner in building a secure financial future. With expert guidance and the right tools, you can make smarter decisions and reach your wealth goals more confidently.

If you’re ready to take the next step, consider reaching out to a few top brokers to learn more about their services. This simple action can help you find a partner who supports your journey to financial success.

Methodology

Our review of the best U.S. brokers for $1M+ investors in 2025 is based on independent research of broker websites, fee schedules, and services. We evaluated fees, wealth-management features, investment access, technology, and client support. Only verified information from sources such as the SEC and FINRA was used. No broker paid for inclusion. This content is educational and not financial advice; investors should consult licensed professionals before making decisions.

Frequently Asked Questions.

Author

Further Reading

Top Wealth Management Strategies for High Income Earners in 2025 Learn how top earners structure investments, taxes, and assets to maximize returns and minimize risks.

Top U.S. Trust Companies for Estate Management in 2025 Explore how professional trust companies safeguard estates and provide continuity alongside your broker.

Investing in Luxury Assets: Wine, Art, Watches See how wealthy investors diversify portfolios with alternative assets that balance financial and lifestyle goals.