Last Updated: November 18, 2025

As we move through 2025, insurance costs continue to climb driven by inflation, market shifts, and evolving customer expectations. With more digital-first insurers and fewer one-size-fits-all plans, comparing policies isn’t just smart it’s essential.

Whether you’re protecting your family, your assets, or your business, the right coverage can make all the difference. A thoughtful comparison helps you avoid overpaying and ensures you’re truly prepared for life’s unexpected turns.

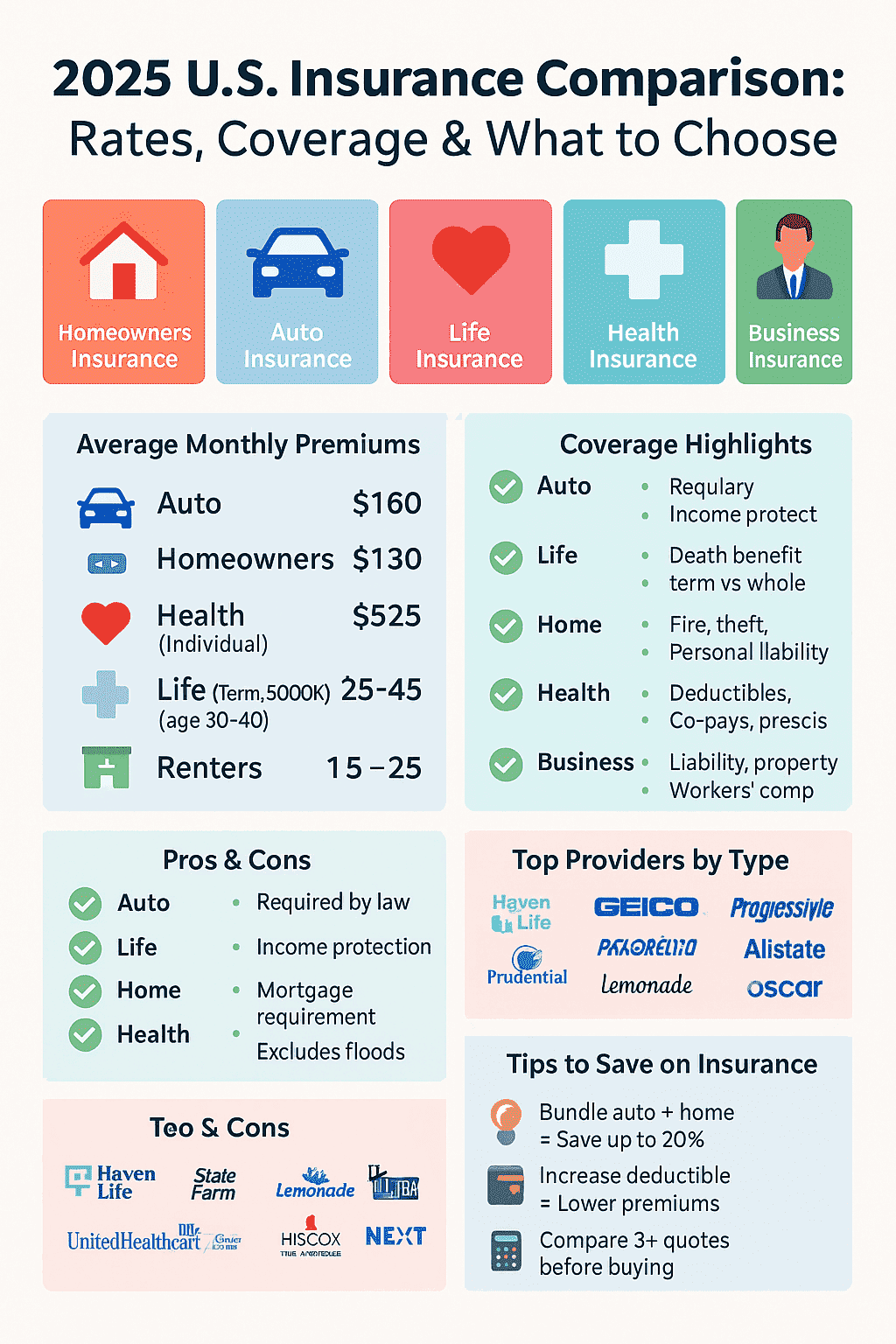

- Comparing insurance in 2025 is more crucial than ever due to rising premiums, digital disruption, and shifting customer expectations.

- Major insurance types include health, auto, home, life, and business—each with unique coverage options, rate structures, and eligibility factors.

- When evaluating plans, prioritize premiums, deductibles, exclusions, digital tools, and provider financial strength using AM Best or Moody’s ratings.

- Top providers like State Farm, USAA, Geico, Allstate, and Northwestern Mutual stand out for service quality, tech features, and claim reliability.

- Smart insurance planning isn’t just about savings—it’s a long-term strategy to protect your assets, income, and generational wealth.

In today’s market, even small coverage gaps or outdated policies can lead to major financial setbacks. From health plans with rising deductibles to auto and home insurance affected by extreme weather and repair costs, knowing your options is key.

Digital innovation has also reshaped how Americans shop for coverage. You can now get instant quotes, AI-based risk assessments, and even manage claims through mobile apps but not all providers offer the same tools or transparency.

That’s why this guide breaks down the best U.S. insurance options for 2025 from real-world rate comparisons to expert tips and provider recommendations. If you’re serious about building financial security, it starts with choosing the right protection.

What Types of Insurance Should You Compare?

Health Insurance

Health insurance is a vital component of financial planning in 2025, as medical expenses continue to rise sharply across the U.S. Different plans offer varying networks, prescription drug coverage, and out-of-pocket costs, making it crucial to compare before committing. Choosing the right plan can reduce unexpected bills while ensuring you have access to quality healthcare providers.

With the rise of high-deductible health plans, many consumers find themselves paying more upfront before insurance kicks in. Understanding how premiums, deductibles, copays, and coinsurance work together helps you avoid costly surprises. Comparing multiple plans annually can reveal better options tailored to your health needs and budget.

Additionally, the shift toward telehealth services and preventive care has made some plans more attractive, especially those covering virtual visits and wellness programs. Carefully reviewing these benefits ensures you take full advantage of modern healthcare offerings, maximizing value beyond just the price tag.

Auto Insurance

Auto insurance costs in 2025 are shaped by factors like your driving history, location, vehicle type, and even credit score. More insurers now use telematics to monitor driving behavior, offering discounts to safer drivers but also introducing new data privacy considerations. Comparing policies helps identify providers that align with your driving habits and financial goals.

Coverage options and claims service vary widely among auto insurers. Some emphasize affordable premiums but may have slower claim responses or restrictive coverage limits. Others prioritize customer service and fast payouts, which can be invaluable after an accident. Reviewing these trade-offs ensures you’re not sacrificing peace of mind for short-term savings.

Drivers should also consider available discounts such as multi-policy bundling, good driver rewards, or low-mileage credits. Comparing different insurers for both cost and perks ensures you don’t miss out on savings opportunities while maintaining robust coverage.

Homeowners & Renters Insurance

Homeowners and renters insurance protect you from financial loss due to property damage, theft, or liability claims. In 2025, increasing risks from natural disasters and rising repair costs mean that reviewing your policy’s limits and exclusions is more important than ever. Not all policies cover flood or earthquake damage by default, so comparing options helps identify necessary add-ons.

Rates can vary significantly based on your home’s location, construction type, and security features like alarms or fire suppression systems. Bundling home insurance with auto or other policies often unlocks discounts, but the quality of claims handling and customer support should also be a deciding factor.

Renters insurance, often overlooked, provides valuable protection for your belongings and liability coverage in case of accidents. Comparing renters policies can ensure you get enough coverage for your possessions without paying for unnecessary extras, helping you stay financially secure on a budget.

Life Insurance (Term & Whole)

Life insurance is a cornerstone of long-term financial planning, providing financial security to your loved ones in the event of your passing. Term life insurance offers affordable coverage for a set period, making it ideal for young families or those with specific time-bound financial responsibilities. Whole life insurance, on the other hand, builds cash value over time and can serve as both protection and an investment vehicle.

Rates for life insurance vary widely based on your age, health, lifestyle, and the type of coverage you select. Shopping around allows you to find policies that fit your unique needs without overpaying. In 2025, many insurers offer simplified underwriting or no-exam policies, making it easier than ever to get covered quickly.

Beyond just death benefits, modern life insurance products include features like accelerated benefits, which can provide funds during a critical illness, and options to convert term policies into permanent ones. Comparing these benefits ensures you choose a policy that not only protects but also supports your broader financial goals.

Business Insurance

For entrepreneurs and professionals, business insurance is essential to mitigate risks that could otherwise derail growth or cause financial ruin. Depending on your industry, you might need general liability, professional liability (errors and omissions), property insurance, or cyber liability coverage. Each type protects different aspects of your business operations.

Costs and coverage options vary widely based on business size, revenue, and risk profile. For example, a freelance consultant’s insurance needs differ greatly from those of a restaurant with staff and physical premises. Comparing policies helps you find the right coverage levels and identify any gaps or unnecessary extras.

As cyber threats and regulatory requirements grow in complexity, many insurers now offer tailored packages for tech companies and startups. Choosing a provider with expertise in your field can mean faster claims resolution and better support, helping you focus on building your business with confidence.

What to Look For When Comparing Insurance

Premiums & Deductibles

When shopping for insurance, monthly premiums often get the most attention but the deductible is just as important. A low premium might seem attractive until you face a high deductible that you must pay before coverage starts. Assessing both lets you find a balance that fits your budget and how much risk you’re comfortable taking.

For example, if you rarely file claims, a higher deductible with lower premiums could save money overall. But if you expect frequent use, a plan with higher premiums and lower deductibles might be wiser. Knowing your personal or family situation helps guide this decision.

Also, keep in mind that some policies have separate deductibles for different types of claims (like collision vs. comprehensive on auto insurance). Make sure you understand all costs involved to avoid surprises during an emergency.

Coverage Limits & Exclusions

Coverage limits set the maximum amount your insurer will pay for a claim, so it’s critical to review these carefully. Whether it’s a health plan’s maximum yearly benefit or a home insurance policy’s dwelling coverage limit, these caps determine how well you’re protected against large expenses.

Exclusions are the scenarios or damages your policy does not cover—these vary widely between insurers. For instance, flood damage typically requires a separate policy, and some health plans exclude certain treatments. Reading the fine print ensures you’re not caught off guard when a claim is denied.

It’s a good idea to compare not only what’s covered but also how different policies handle things like pre-existing conditions, natural disasters, or liability limits. Tailoring coverage to your specific risks can prevent costly gaps.

Customer Service & Claims Experience

Good customer service can make a stressful claims process much easier. Insurers with high ratings from J.D. Power or positive Better Business Bureau reviews usually provide faster responses and fairer settlements. Before committing, check reviews and complaint records to see how the company treats its customers.

Fast, transparent claims processing is a must-have feature, especially after emergencies. Some insurers now offer AI-driven claims adjustments and 24/7 support, helping you get paid quickly and accurately. This level of service can save time and frustration when you need it most.

Finally, consider the accessibility of your insurer’s support channels. Multiple contact methods, user-friendly mobile apps, and online claim tracking are key features that enhance your overall experience in 2025’s digital-first insurance market.

Digital Tools & Ease of Claims

In 2025, insurance customers expect seamless digital experiences that simplify managing their policies. Mobile apps that let you file claims instantly, track progress in real-time, and receive quick payouts are no longer luxuries—they’re essentials. Insurers like Lemonade and Root have raised the bar by using AI and automation to speed up quotes and claims, making the process smoother and more transparent.

Beyond filing claims, digital tools help you customize coverage, update personal info, and even access digital ID cards without calling customer service. When comparing insurers, pay close attention to app reviews and user feedback to see how intuitive and reliable their platforms are. A strong digital ecosystem can save you time and reduce headaches when you need support.

As more consumers prefer managing insurance on their smartphones, providers investing in technology tend to offer better overall experiences. If convenience and speed matter to you, prioritize insurers with robust digital offerings in your comparison.

Financial Strength (AM Best, Moody’s, Fitch)

Choosing an insurer with strong financial stability is crucial to ensure they can honor claims when it counts. Independent rating agencies like AM Best, Moody’s, and Fitch evaluate insurers’ ability to meet financial obligations, especially during economic downturns or catastrophic events. A high rating signals reliability and peace of mind.

While lower-rated companies might offer tempting premiums, the risk is that they could delay or deny claims due to financial strain. In 2025’s unpredictable market, opting for well-rated insurers protects you from potential payout issues. Always check the latest ratings before finalizing your choice.

Financial strength isn’t just about paying claims it also reflects the insurer’s capacity to invest in technology, customer service, and new products, which benefits you as a policyholder over time.

Available Discounts

Many insurers offer a variety of discounts that can significantly reduce your premiums without compromising coverage. Common savings include bundling multiple policies (like home and auto), good driver discounts, and loyalty rewards. For students or professionals, special programs may apply, making it worthwhile to inquire about all possible incentives.

Telematics-based discounts, where insurers monitor driving habits through apps or devices, have become increasingly popular in 2025. Safe drivers can lower rates by demonstrating responsible behavior, turning everyday habits into real savings. Even small discounts add up, improving your overall financial picture.

When comparing policies, always ask insurers about available discounts and eligibility requirements. Sometimes, just asking or updating your profile with new information like adding a security system or completing a defensive driving course can unlock additional savings.

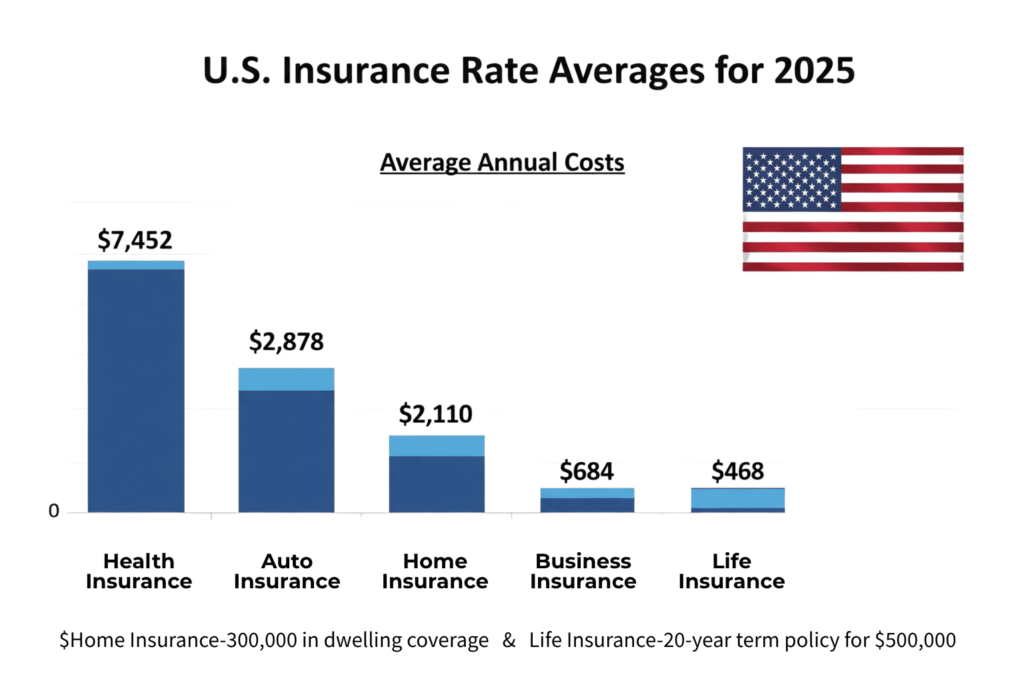

2025 Insurance Rates Comparison (Estimated Averages)

| Coverage Level | Individual (30 y/o) | Family of 4 |

|---|---|---|

| Bronze Plan | $380 | $1,050 |

| Silver Plan | $490 | $1,390 |

| Gold Plan | $580 | $1,650 |

| Driver Profile | Average Cost |

|---|---|

| Single, Age 25 | $1,980 |

| Married, Age 40 | $1,350 |

| Senior, Age 65 | $1,420 |

| Poor Credit Score | $2,800+ |

| Property Value | Average Cost |

|---|---|

| $250,000 | $1,000 |

| $500,000 | $1,850 |

| Coastal Property | $2,500+ |

| Age / Coverage | Monthly Premium |

|---|---|

| Age 30 / $500K | $28 |

| Age 40 / $500K | $41 |

| Age 50 / $500K | $76 |

| Business Type | Average Cost |

|---|---|

| Solo Consultant | $600 |

| Restaurant (10 employees) | $4,200 |

| Tech Startup (Remote) | $2,800 |

Expert Tips on Choosing the Right Provider

When to Shop Around or Switch

Insurance needs evolve over time, so regularly reviewing your coverage is essential especially after major life events like marriage, buying a home, or starting a business. Experts recommend shopping around at least once a year to ensure you’re not missing better deals or improved benefits. Waiting too long can mean overpaying or staying stuck with outdated policies that don’t fit your current needs.

Switching providers can feel daunting, but it often leads to significant savings or better service. Just be sure to time your switch carefully to avoid gaps in coverage or penalties for early cancellation. Comparing renewal offers side-by-side with new quotes gives you a clear picture of your best options.

Keep an eye on changes in the insurance market, too. New entrants and digital-first companies frequently introduce innovative products and pricing models that could save you money or provide enhanced coverage. Staying informed ensures you capitalize on these opportunities when they arise.

Independent Brokers vs. Direct Buying

Choosing between working with an independent broker or purchasing insurance directly from a provider depends on your preferences and complexity of your needs. Brokers can offer access to multiple carriers and help tailor policies to your unique situation. Their expert guidance often uncovers options you might miss on your own.

Direct buying, especially through online platforms, offers convenience and sometimes lower premiums by cutting out the middleman. If you have straightforward coverage needs and feel comfortable comparing policies yourself, direct purchase can be quick and cost-effective. However, you may sacrifice personalized advice.

For complex insurance needs like business or life policies, an independent broker’s expertise can be invaluable. They can help navigate fine print, identify gaps, and negotiate better terms. Ultimately, your choice should balance cost, convenience, and the level of support you want.

Hidden Fees or Pitfalls to Avoid

Not all insurance policies are created equal some carry hidden fees or restrictive clauses that can undermine your coverage. Watch out for charges like administrative fees, cancellation penalties, or costly riders that add little value. These extras can quietly inflate your total costs if overlooked.

It’s also important to scrutinize policy language for exclusions or limitations that could leave you exposed. For example, some health plans exclude certain pre-existing conditions or elective procedures. Auto policies might have gaps in coverage for rental cars or roadside assistance unless explicitly added.

Before signing, ask insurers to clearly explain all fees and terms in plain language. Doing so prevents surprises down the line and ensures your policy delivers the protection you expect. A well-informed buyer is better positioned to negotiate favorable rates and conditions.

Negotiate Better Work Rates

Many people don’t realize that insurance rates aren’t always set in stone there’s often room to negotiate, especially when renewing or shopping around. Start by gathering multiple quotes to use as leverage with your current insurer. Mentioning competitive offers can motivate them to match or beat prices to keep your business.

Highlight your good driving record, healthy lifestyle, or claim-free history to strengthen your case for discounts or lower premiums. Some insurers also offer loyalty rewards or accident forgiveness programs that you can request explicitly during negotiations. Being proactive and polite goes a long way.

Additionally, bundling multiple policies like home and auto with the same company often unlocks substantial savings. Don’t hesitate to ask about unadvertised discounts or premium reductions based on your profession, memberships, or safety upgrades. Negotiation is about open communication, so always ask what’s possible.

Best Insurance Providers in the U.S. (2025 Picks)

Final Thoughts

As we navigate 2025’s uncertain economy where inflation, climate risk, healthcare costs, and digital threats continue to evolve insurance has moved from a financial afterthought to a cornerstone of smart planning. It’s not just about saving money on monthly premiums. It’s about building lasting protection that aligns with your family’s needs, your career path, or your business ambitions.

Far too many people stick with outdated policies out of convenience, unaware they could be missing out on better service, broader coverage, or significant savings. By actively comparing insurance providers each year or during major life or business milestones you put yourself in control. You’re no longer a passive customer; you’re a strategic policyholder who shops with clarity and negotiates from strength.

The best insurance isn’t always the cheapest or the most advertised. It’s the one that offers peace of mind when a crisis hits, supports your financial goals over time, and evolves as your life changes. Whether you’re protecting a growing family, launching a business, or preparing for retirement, insurance is your financial safety net one that should be reviewed, strengthened, and optimized as often as any investment portfolio.

Don’t wait until disaster strikes to find out if your policy is enough. Be proactive. Compare providers. Ask questions. Negotiate terms. And most importantly choose coverage that builds resilience, not just reacts to emergencies. That’s how you protect not only your present, but your long-term wealth and well-being.

Start comparing today and turn your insurance strategy into a powerful asset for life.