Last Updated: November 18, 2025

Life insurance isn’t just about preparing for the unexpected it’s a smart financial move that helps protect the people you love most. Whether you’re providing for a young family, building long-term wealth, or thinking ahead about your legacy, the right policy can offer both peace of mind and powerful benefits.

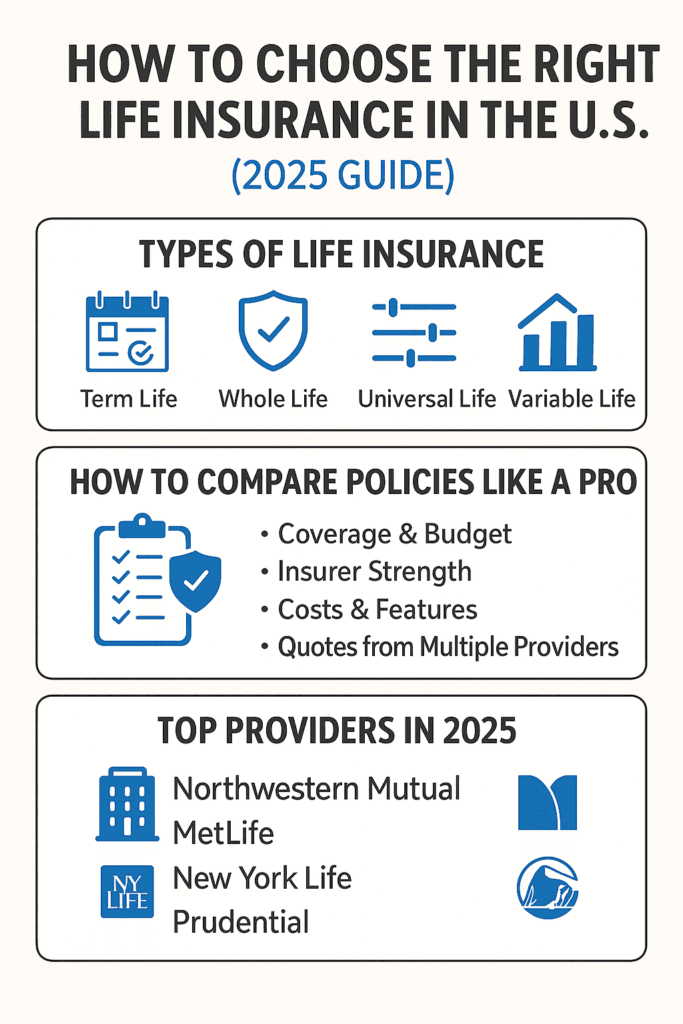

In today’s world, life insurance has evolved far beyond a simple payout. It can be a tool for tax planning, retirement income, business protection, and even growing generational wealth. But with so many options term, whole, universal, variable it’s easy to feel overwhelmed or make the wrong choice.

That’s why this guide exists. We’re cutting through the clutter to help you choose the best life insurance policy for your needs in 2025 based on real data, expert insights, and practical tips. Whether you’re a first-time buyer or reevaluating your current plan, you’ll learn how to compare providers, understand key features, and avoid costly mistakes.

By the end, you’ll not only know what type of policy is right for you – you’ll feel confident, informed, and ready to take control of your financial future. Let’s get started.

- Choosing the right life insurance policy safeguards your family’s financial future and can be a powerful wealth-transfer tool.

- Term, whole, universal, and variable policies each offer unique benefits understanding their pros and cons is critical.

- Compare quotes across multiple carriers look at premiums, death benefits, riders, financial strength, and customer service.

- The top five U.S. carriers in 2025 are Northwestern Mutual, MetLife, New York Life, Prudential, and MassMutual each with strong ratings and diverse product lineups.

- Tailor your policy choice to your life stage: young families may favor affordable term coverage, while high-net-worth individuals often leverage permanent policies for estate planning and tax benefits.

Why Choosing the Right Life Insurance Matters

Choosing the right life insurance is more than just checking a box on your financial to-do list. It’s a decision that affects your loved ones, your long-term goals, and even how you grow and protect wealth. The right policy can help your family stay financially stable, reduce future tax burdens, and give you peace of mind that they’ll be taken care of no matter what happens. In 2025, with so many insurance options and financial tools available, understanding why life insurance matters has never been more important.

Wealth Protection

Life insurance acts as a financial safety net when your family needs it most. If something happens to you, the death benefit can replace your income, pay off your mortgage, and even fund your children’s college education. It ensures your loved ones won’t face financial stress during an already difficult time.

Tax Efficiency

Certain life insurance policies especially whole and universal life come with built-in tax advantages. The cash value inside these policies grows tax-deferred, meaning you won’t pay taxes on gains as they grow, and in many cases, you can borrow from that value tax-free. It’s a smart way to combine protection with long-term financial planning.

Estate Planning

For high-net-worth individuals, life insurance isn’t just protection it’s a tool for legacy building. Policies held in structures like Irrevocable Life Insurance Trusts (ILITs) can reduce estate taxes and ensure wealth passes smoothly to the next generation. This strategy is often used to preserve family businesses or large real estate holdings.

Peace of Mind

Beyond numbers and benefits, life insurance offers something deeply valuable emotional peace. Knowing your spouse, children, or dependents will be financially secure brings a level of comfort that money alone can’t buy. It’s not just about dying it’s about living with confidence in the future.

Types of Life Insurance Explained

There’s no one-size-fits-all when it comes to life insurance. Different policies serve different goals some offer simple, low-cost protection, while others build long-term value or support estate planning. Understanding how each type works is the first step in choosing the coverage that truly fits your life, your family, and your future plans. Let’s break them down clearly so you can make the most informed decision.

Term life insurance

Pros

Lowest Initial Premiums

Term policies are the most budget-friendly way to get high coverage amounts. That’s why they’re popular among young families, new homeowners, and professionals just starting out. For a low monthly cost, you can protect your income and your dependents.

Simplicity of Coverage

There’s no confusing cash value or investment performance to track just coverage for a fixed period. This simplicity makes it easy to understand, easy to manage, and ideal for people who want straightforward protection without complexity.

Convertible to Permanent Policies

Many term policies offer a conversion option, allowing you to switch to a whole or universal policy later often without a medical exam. This flexibility is great if your budget grows or your needs shift over time.

Cons

No Cash Value Accumulation

Unlike permanent policies, term life doesn’t build any savings or investment component. If you outlive the policy term, you don’t get anything back. It’s pure insurance, not a financial asset.

Coverage Expires at Term’s End

Once the term is over, the coverage stops unless renewed, often at much higher rates. This can catch people off guard if they still need protection but face new health risks or age-related premium spikes.

Premiums Increase Upon Renewal

If you choose to renew your policy after it ends, the premium can rise dramatically. This makes it harder to keep coverage affordable later in life, especially without re-qualifying with new medical exams.

Real-World Example

A healthy 30-year-old non-smoker can lock in a 20-year, $500,000 term policy for as little as $25/month in 2025. It’s a smart option for replacing lost income during the years when a family or mortgage is most dependent on you.

Whole Life Insurance — Lifetime Coverage with Guaranteed Growth

Pros

Lifetime Protection

This policy never expires, which means your beneficiaries are guaranteed a death benefit, no matter when you pass away. That certainty makes it ideal for long-term planning, final expenses, and leaving a legacy.

Guaranteed Cash Value Growth

Part of your premium goes into a savings-like account that builds value over time. That cash value grows on a fixed, predictable schedule making it one of the most stable forms of wealth accumulation in insurance.

Dividends from Mutual Carriers

If you purchase a whole life policy from a mutual insurance company, you may receive dividends. While not guaranteed, these can increase your policy’s value or reduce premiums, adding to the long-term financial benefits.

Cons

Higher Premiums vs. Term

Whole life policies can cost 5 to 15 times more than term insurance for the same coverage amount. That makes them less accessible for younger buyers or those on a tight budget.

Less Flexibility in Premium Payments

Whole life insurance locks you into fixed premiums. While this offers predictability, it doesn’t allow you to adjust payments based on income changes or evolving financial priorities.

Slower Early Cash Value Growth

In the first few years, the cash value accumulates slowly due to front-loaded administrative and insurance costs. It’s a long-term asset, so early surrender or short-term thinking can lead to disappointing returns.

Real-World Example

A 40-year-old paying around $350/month for whole life could build up $50,000 in cash value after 10 years. It’s a good fit for those who want guaranteed protection and are also looking to build low-risk, tax-advantaged savings.

Universal Life Insurance — Flexible, Adjustable, and Long-Term

Pros

Premium Flexibility

Unlike whole life, you’re not locked into a fixed payment. You can increase, decrease, or skip payments (as long as there’s enough cash value), which makes this policy more adaptable to income changes or financial emergencies.

Cash Value Earns Interest

The policy’s cash value earns interest based on market rates, typically linked to bonds or general account yields. When rates are high, your cash value grows faster, offering more potential than whole life.

Adjustable Coverage Amounts

You can raise or lower your death benefit within certain limits, depending on your life stage or goals. For example, you might reduce coverage after your kids graduate or increase it when you start a business.

Cons

Performance Tied to Interest Rates

The cash value growth depends on external rates. If market interest drops or stays low, your policy could grow slower than expected, reducing its financial effectiveness over time.

Risk of Policy Lapse

If the interest earned or cash value isn’t enough to cover internal costs, your policy can lapse especially if you skip payments. This makes it more hands-on and risky without careful monitoring.

Complex Illustrations and Assumptions

Universal life policies often come with projections based on optimistic assumptions. If you’re not cautious, you could expect more value than the policy realistically provides leading to surprise shortfalls.

Variable Life Insurance — Investment-Linked Coverage with Growth Potential

Pros

Market-Driven Growth Potential

Unlike other policies, the cash value can grow significantly if your chosen investments perform well. For investors with a long horizon and risk tolerance, it can offer returns far beyond fixed-interest policies.

Control Over Investment Choices

You choose how to allocate your cash value among various funds stocks, bonds, balanced portfolios. This control lets you align your insurance with your personal investment strategy.

Potential for Increased Death Benefit

If your investments grow, your policy’s death benefit may also rise providing more value to beneficiaries and aligning your insurance with long-term financial success.

Cons

Investment Risk on Policyholder

If the market dips, your cash value and potentially your death benefit can decline. You carry the risk, and there are no guarantees, which makes it unsuitable for conservative savers.

Higher Management Fees

Variable policies typically come with fund management fees, insurance charges, and administrative costs. These can eat into gains and make the policy expensive to maintain.

Requires Active Monitoring

Because it’s tied to investments, you can’t just set it and forget it. You need to regularly monitor performance, rebalance funds, and understand market movements otherwise, the policy could underperform.

How to Compare Policies Like a Pro

Choosing the right life insurance policy is one of the most important financial decisions you’ll make, yet it can feel overwhelming with so many options, terms, and fine print to navigate. The good news? You don’t have to be an insurance expert to make a smart choice. By breaking down the process into clear, manageable steps, you can confidently compare policies based on what truly matters for your unique situation.

Every policy isn’t the same even if two offer the same coverage amount, the costs, features, and flexibility can differ drastically. Understanding these key differences saves you money and protects your family more effectively. Plus, knowing how to read policy details helps you avoid surprises like unexpected premium hikes or coverage gaps.

This guide walks you through the exact factors professional advisors use when helping clients. From calculating how much coverage you need, to checking the financial health of insurers, and evaluating policy perks and fees it’s all about making an informed, personalized choice.

By learning to compare like a pro, you’ll not only pick the right policy you’ll feel confident that your decision supports your long-term financial goals, safeguards your loved ones, and fits comfortably within your budget.

Assess Your Needs & Budget

Before you dive into quotes, take a clear look at your financial situation and future obligations. A common rule of thumb is to aim for coverage equal to 10 to 12 times your annual income, which helps replace lost earnings and cover debts like mortgages or loans. Don’t forget to factor in big future expenses like college tuition or retirement costs for your dependents.

At the same time, be realistic about how much premium you can afford monthly or annually not just now but over the long haul. A policy is only valuable if you can keep paying for it consistently. Balancing coverage needs with an affordable budget protects you from lapsing policies and gaps in protection.

Analyze Carrier Financial Strength

The insurance company’s financial health is critical because you want assurance they’ll be able to pay claims decades from now. Trusted rating agencies like A.M. Best give insurers grades based on their stability; aim for companies with an “A” rating or higher.

If you’re considering a mutual insurer (where policyholders can earn dividends), check recent dividend payment history. Consistent or growing dividends reflect strong performance and company reliability. Remember, the company backing your policy is just as important as the policy itself.

Understand Policy Costs

Not all premiums are created equal. Level premiums remain the same throughout the policy term, while guaranteed level premiums lock in the cost but might be higher upfront. Know which type you’re buying to avoid surprises later.

Besides premiums, policies have additional fees like the cost of insurance charges, administrative fees, and costs for optional riders. These can significantly affect the overall price, so request a full cost breakdown before committing. Understanding these details helps you compare apples to apples.

Evaluate Riders & Flexibility

Riders are extra features or benefits you can add to customize your policy. Common riders include accelerated death benefits (which let you access funds if diagnosed with a terminal illness), waiver of premium (pausing payments if you become disabled), child term coverage, or return of premium options.

Equally important is how flexible the policy is about adding, changing, or removing riders later on. A policy that adapts to your changing life circumstances provides better long-term value and peace of mind.

Customer Service & Claims Experienc

How easy is it to deal with the insurer? Strong customer service makes a big difference, especially when filing claims. J.D. Power’s customer satisfaction rankings offer an independent view of insurer reputations look for carriers with high scores.

Another key metric is the claims-payment ratio, which shows how often insurers pay out claims versus denying them. Higher-rated insurers typically pay 95% or more of legitimate claims. Choosing a company with a proven track record here means fewer headaches and quicker support for your family.

Get Multiple Quotes

Don’t settle for the first quote you receive. Use an insurance broker or aggregator websites to compare at least 3 to 5 carriers. This broadens your options and ensures competitive pricing.

Keep in mind underwriting guidelines differ by insurer. Some companies specialize in covering preferred-risk applicants with excellent health and may offer better rates, while others are more lenient with pre-existing conditions but charge higher premiums. Matching your profile with the right carrier can save you significant money.

Top 5 Life Insurance Providers in the U.S. (2025)

Choosing a reputable insurer is as critical as picking the right policy type. The financial strength, customer satisfaction, and product variety offered by the carrier impact both your peace of mind and the policy’s long-term value. Below are the top five life insurance companies in the U.S. by market share in 2025, along with what sets each apart.

Northwestern Mutual (10.92% Market Share)

Northwestern Mutual leads the U.S. life insurance market with nearly 11% market share, a testament to its long-standing reputation and financial strength. Rated A++ (Superior) by A.M. Best the industry’s gold standard for insurer stability it offers unmatched reliability.

What makes Northwestern Mutual unique is its mutual structure, meaning policyholders are also owners. This ownership model often results in dividend payments to policyholders, reflecting strong company profits shared back with clients. The company excels in whole life insurance and has a broad portfolio including term, universal, and variable life policies.

NerdWallet and other top personal finance sites consistently rate Northwestern Mutual highly for customer satisfaction and comprehensive financial planning services. The insurer is known for personalized advice, making it a popular choice for families and professionals seeking tailored long-term financial solutions.

MetLife (6.35% Market Share)

MetLife holds a significant 6.35% share, especially strong in group insurance through employers, but also competitive in individual life insurance products. Its individual policies are now primarily offered through its spinoff, Brighthouse Financial, which focuses on flexible, consumer-friendly options.

The company is recognized for its wide range of products from affordable term life plans to more complex indexed and variable universal life policies. This breadth makes it suitable for different financial goals and risk tolerances.

MetLife’s presence in the group insurance market also provides strong value for business owners seeking employee benefits. The insurer is regulated and rated well by the National Association of Insurance Commissioners (NAIC), ensuring consumer protections are in place.

New York Life (4.03% Market Share)

New York Life is another mutual insurer with over 175 years of history, commanding about 4% of the U.S. market. It’s known for strong dividend performance, regularly paying out consistent and often growing dividends to policyholders.

The company scores top marks in customer satisfaction surveys such as J.D. Power, reflecting its commitment to service and claims handling. New York Life’s product suite is comprehensive, including term, whole, universal, and variable life policies, plus specialized options for estate planning and business owners.

Policyholders appreciate the financial strength, which A.M. Best rates as A++ (Superior), ensuring the company’s ability to meet long-term obligations.

Prudential (7.94% Market Share)

Prudential holds nearly 8% of the market and is known for a broad product lineup, including indexed universal life insurance, which offers growth potential tied to stock market indexes without direct stock market risk.

Unlike the mutual companies above, Prudential is a publicly traded company with a global footprint. This gives it access to significant capital and diverse financial expertise, but it doesn’t pay dividends to policyholders as mutual companies do.

Prudential’s strength lies in its innovation and flexibility, appealing to investors and professionals who want to integrate life insurance into their overall wealth strategy. It’s highly rated for financial stability and customer service by NAIC and independent rating agencies.

MassMutual (5.26% Market Share)

MassMutual, with just over 5% market share, is a mutual life insurer well-regarded for strong dividend performance and superior customer service. Like Northwestern Mutual and New York Life, it shares profits with policyholders through dividends, boosting cash value and benefits over time.

It offers a full range of life insurance products, including whole life, term, universal, and variable life. MassMutual’s reputation for financial strength and transparent communication makes it a favorite for families and investors looking for dependable long-term coverage.

The company’s customer service and claims satisfaction scores are among the best in the industry, reinforcing its commitment to policyholder value.

Why These Providers Matter in 2025

All these top carriers share strong financial ratings, ensuring they can pay claims and remain stable through market cycles. Their product diversity covers nearly every financial goal—from basic income replacement to advanced estate planning and wealth transfer.

For consumers in 2025, selecting any of these carriers means partnering with trusted companies offering transparency, innovation, and customer-first service. When choosing your insurer, consider not only rates but also carrier reputation, dividend history (if mutual), and the range of customizable options available to you.

Life Insurance for Different Needs

Life insurance isn’t one-size-fits-all. Different life stages, professions, and financial goals call for tailored strategies to maximize coverage and value. Below is a guide to which policies and features work best for key groups, helping you match your insurance to your unique situation.

Families

For families, especially those with young children or a mortgage, the primary goal of life insurance is protecting your household’s financial security if something unexpected happens. The most popular and practical choice is a 20- to 30-year term policy, which provides affordable, high-coverage protection during the years your income is critical.

Families should also consider adding riders like child term insurance, which provides a death benefit if something happens to a minor child, or critical illness riders that pay out if a serious health event occurs. Additionally, a disability waiver rider can cover your premiums if you become disabled and unable to work, ensuring continuous protection without financial strain.

This layered approach helps safeguard your family against multiple risks while keeping premiums manageable during the years you need protection most.

Young Professionals

Young professionals just starting their careers have an opportunity to lock in life insurance at lower rates due to their age and health status. A 10- or 20-year term policy with a conversion option is often the best fit, allowing them to start with affordable coverage and switch to a permanent policy later without new medical exams.

A smart strategy for this group is laddering coverage—buying higher coverage amounts during peak financial obligations like rent, student loans, and new family expenses, then gradually reducing coverage as debts are paid off and savings grow. This approach optimizes costs while maintaining adequate protection during critical periods.

Starting early also builds a financial foundation that supports future wealth-building and estate planning.

Self-Employed & Entrepreneurs

For business owners and self-employed professionals, life insurance serves dual purposes: personal financial security and business protection. Universal life insurance is often preferred here because of its premium flexibility, allowing adjustments to payments based on cash flow fluctuations common in entrepreneurship.

Additionally, key-person insurance is a must-have for protecting the business against financial loss if an essential leader or founder passes away unexpectedly. This coverage helps the company cover costs or transition smoothly during tough times.

From a tax perspective, premiums paid on policies covering corporate officers or partners may be deductible as a business expense an advantage that can improve overall tax efficiency. Business owners should consult a tax advisor to structure policies optimally.

High-Net-Worth Investors

For high-net-worth individuals, life insurance becomes a sophisticated tool for estate planning and wealth preservation rather than simple income replacement. Variable or indexed universal life policies are often used inside an Irrevocable Life Insurance Trust (ILIT) to minimize estate taxes and protect assets for heirs.

Advanced strategies like premium financing allow wealthy investors to borrow funds to pay large policy premiums. This technique leverages capital, preserves liquidity, and amplifies returns while providing substantial death benefits. It’s a complex approach that requires professional financial and legal guidance.

These tailored policies offer powerful benefits beyond basic protection, helping investors pass wealth efficiently to the next generation and maintain financial flexibility.

Common Mistakes to Avoid When Buying Insurance

Buying life insurance is a crucial financial decision, but many people unknowingly make mistakes that can cost them money, leave them underprotected, or cause frustration down the line. Being aware of these pitfalls will help you choose smarter and more suitable coverage.

Overbuying or Underbuying Coverage

One of the most common errors is not matching your policy size to your true financial needs. Buying too much insurance can mean paying unnecessarily high premiums that strain your budget without added value. Conversely, underbuying leaves your loved ones vulnerable to financial hardship if you pass away prematurely.

The key is to calculate coverage based on realistic future obligations such as income replacement, debt payoff, college expenses, and final costs and revisit this periodically as your situation evolves. Striking this balance ensures you get enough protection without overspending.

Ignoring Policy Fees & Illustrations

Insurance marketing often highlights attractive “illustrated” returns on cash value or dividends. However, these are projections based on optimistic assumptions that may not materialize, especially if interest rates or dividends fall.

It’s critical to look closely at all policy fees including administrative charges, cost of insurance, and rider costs that impact your actual returns and cash value growth. Running stress tests or conservative scenario analyses with your agent or advisor can reveal how the policy performs under less favorable conditions, helping you avoid surprises later.

Loyalty Bias

Many people assume their current auto or homeowners insurance company offers the best life insurance rates or products, simply out of convenience or brand familiarity. This loyalty bias can prevent you from finding significantly better deals or more suitable policies elsewhere.

Life insurance providers specialize differently, and rates can vary widely based on underwriting criteria, policy types, and promotions. Shopping around and comparing quotes from multiple carriers ensures you don’t overpay or miss out on better coverage options.

Skipping Medical Exams

In the interest of convenience, some buyers opt for no-exam life insurance policies, which don’t require medical testing. While this speeds up approval, it comes at a cost: premiums for larger coverage amounts can be 20% to 30% higher compared to fully underwritten policies.

For substantial coverage or long-term savings, completing a medical exam often leads to significantly lower premiums and better rates, especially if you’re healthy. Unless you have a compelling reason to avoid exams, investing the time upfront usually pays off in premium savings.

Final Thoughts: Securing Your Financial Legacy with the Right Life Insurance

Choosing the right life insurance policy is more than just a financial transaction—it’s a deeply personal decision that safeguards the future of those you care about most. A well-selected policy acts as a cornerstone of your long-term financial plan, offering protection, tax advantages, and peace of mind.

Understanding the distinct types of life insurance, from term to permanent options, empowers you to align coverage with your unique needs, whether you’re protecting young children, building wealth, or planning your estate. Equally important is rigorously comparing multiple quotes and carriers, ensuring you partner with a financially strong company that will stand by your family decades from now.

Remember that life insurance needs evolve as your circumstances change. Regularly reviewing your policy in response to major life events such as marriage, buying a home, or welcoming a new child keeps your coverage relevant and effective. Taking these steps today positions you to protect your legacy, maximize tax efficiency, and provide your loved ones with financial stability, no matter what the future holds.

Next Steps to Take Now

Compare Quotes: Start by obtaining 3 to 5 personalized quotes from reputable brokers or online aggregators. This side-by-side comparison helps you find the best rates and policy features tailored to your profile.

Review Your Strategy Annually: Your insurance needs are not static. Life changes require policy updates to maintain adequate protection and optimize benefits.

Stay Informed: The world of life insurance and wealth management is dynamic. Subscribe to trusted resources to stay up to date on new products, tax strategies, and estate planning insights.

Further Reading & Resources

For a deeper dive into strategic uses of life insurance in your financial plan, explore these expert resources:

https://novozora.com/how-to-use-life-insurance-as-an-investment-in-2025/ — Novozora

Multi-Million Dollar Life Insurance Policies: What to Know — Novozora

Life Insurance Basics — Investopedia

Life Insurance Guide — NerdWallet

Subscribe for more expert insights on life insurance, wealth preservation, and tax-efficient planning and explore our related guides to keep your financial future secure.